RV financing refers to the process of securing funds to purchase a recreational vehicle (RV) through various loan options. Whether you dream of hitting the open road in a motorhome or camping in style with a travel trailer, understanding the ins and outs of RV financing is essential to make an informed decision.

Loan Options for RV Financing

When it comes to RV financing, you have several loan options to choose from. The most common ones are conventional RV loans, secured loans, and personal loans. Conventional RV loans are specifically designed for financing RVs and often offer more favorable terms. Secured loans use your RV as collateral, while personal loans are unsecured and typically have higher interest rates.

Interest Rates and Down Payments

Interest rates for RV loans can vary based on factors like your credit score and the loan term. Generally, interest rates for RV loans are higher than those for traditional home loans but lower than credit card rates. A down payment is a crucial aspect of RV financing. The more substantial your down payment, the lower your monthly payments will be. Aim for a down payment of at least 10-20% of the RV’s purchase price.

Credit Requirements

Your credit score plays a significant role in RV financing. Lenders use credit scores to assess your creditworthiness and determine the interest rate you qualify for. A higher credit score usually translates to better loan terms. However, even if you have a lower credit score, you can still secure RV financing, albeit at a higher interest rate.

Securing the Best Financing Deal

To secure the best financing deal for your RV, follow these essential tips:

- Shop Around: Don’t settle for the first loan offer you receive. Compare rates and terms from multiple lenders to find the most favorable deal.

- Negotiate: Don’t be afraid to negotiate with lenders. Sometimes, they may be willing to lower the interest rate or offer more favorable terms to win your business.

- Consider Loan Term: While longer loan terms may result in lower monthly payments, they can also lead to higher overall interest costs. Choose a loan term that fits your budget while minimizing interest expenses.

- Beware of Add-Ons: Some dealers may try to include unnecessary add-ons in your loan, such as extended warranties or insurance. Be cautious and only agree to what you genuinely need.

- Pre-Approval: Getting pre-approved for an RV loan can give you a better idea of how much you can afford and strengthen your bargaining position when negotiating with dealers.

- Read the Fine Print: Always carefully read and understand the terms of your RV financing agreement before signing. Pay attention to hidden fees or prepayment penalties.

Summary

Financing an RV involves various aspects that can significantly impact your overall RV ownership experience. Knowing the loan options, interest rates, down payments, loan requirements and tips for getting the best deal is crucial. Start your RV trip with peace of mind by researching, comparing offers, and educating yourself. This helps to make a decision with confidence.

![CRX_[HERO]_SHADOW](https://designrv.com.au/wp-content/uploads/2023/04/CRX_HERO_SHADOW.png)

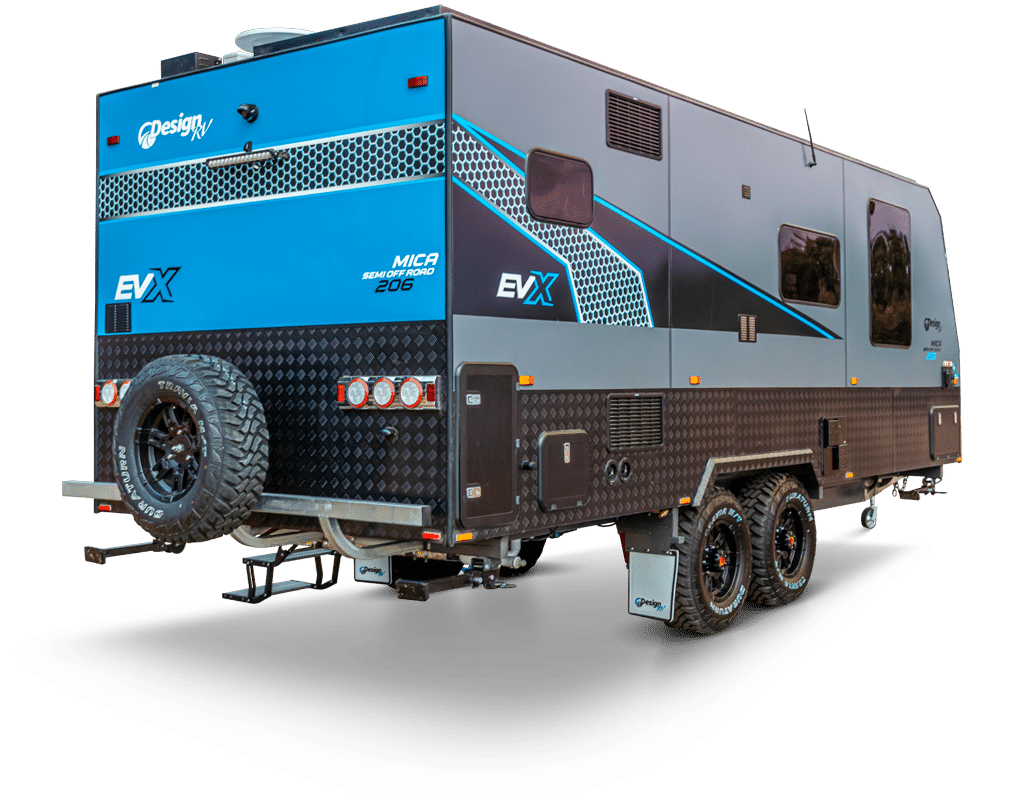

![MICA-EVX_[HERO]_SHADOW](https://designrv.com.au/wp-content/uploads/2023/04/MICA-EVX_HERO_SHADOW.png)

![MICA-OFF-ROAD_[HERO]_SHADOW](https://designrv.com.au/wp-content/uploads/2023/04/MICA-OFF-ROAD_HERO_SHADOW.png)

![STRYKER_[HERO]_SHADOW](https://designrv.com.au/wp-content/uploads/2023/04/STRYKER_HERO_SHADOW.png)

![MICA-206_[HERO]_SHADOW](https://designrv.com.au/wp-content/uploads/2023/04/MICA-206_HERO_SHADOW.png)

![GETAWAY_[HERO]_SHADOW](https://designrv.com.au/wp-content/uploads/2023/04/GETAWAY_HERO_SHADOW.png)